How to compare travel insurance

When it comes to something as important as travel insurance, you should be confident that you’re protected by the level of cover you need. But not all travel insurance is made equal, and finding a policy to suit you can sometimes be a minefield of confusing jargon and lengthy T&Cs.

This guide to comparing travel insurance will outline the key things to look for in a policy, dive into how our insurance stacks up, and give you some tips on how to find the right cover for you, regardless of whether you're travelling internationally or domestically.

What is travel insurance?

Travel insurance is a contract between you and an insurance provider. The travel insurance company agrees to compensate you for the cost of unexpected events (e.g. if your luggage is lost overseas). To receive this cover, you must adhere to the terms and conditions of your policy (e.g. not leaving your luggage unattended).

Travel insurers provide cover for many types of unexpected events, like medical emergencies, natural disasters and lost luggage. The amount of compensation they agree to provide is usually different for each of these types of events, and is often called a ‘benefit limit’.

Why buy travel insurance?

From slips and trips to lost luggage, none of us are immune to unexpected events taking place when we're travelling. These unexpected events can end up costing you lots of money, especially if you’re travelling by plane, or your destination is overseas and has expensive medical care.

Some of our highest claims have come from unlucky overseas travellers who have required emergency medical care, with many of these medical bills reaching over $100,000. In fact, our highest claim of 2022 totalled over $1m!*

Travel insurance can give you peace of mind that you’re protected if the unexpected happens.

Things covered by travel insurance

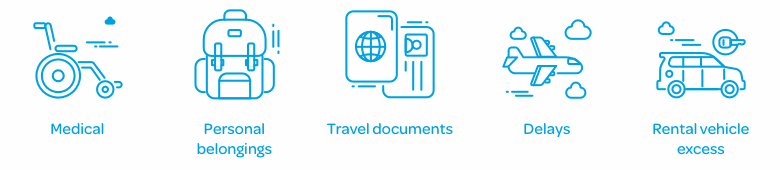

Different travel insurance policies offer different benefits. Our International Comprehensive policy can cover you for things like:

- Medical and evacuation

- Cancelling or changing your journey before you leave

- Lost or stolen items

- Bank cards, passport and travel documents

- Personal accident

- Personal liability

- Rental vehicle excess

- Cash allowance while in hospital

- Emergency dental treatment

- Overseas funeral expenses

- Changes to your journey once you have left

- Some COVID-19 events

Some insurers may also offer policies that focus only on providing cover for medical expenses for your overseas adventure. For example, our International Medical Only policy covers you for medical and evacuation and personal liability such as:

- Medical treatment

- Doctors' visits

- Prescribed medication

- Specialist treatment

- Medical transport costs

- 24 hour emergency assistance.

Staying local?

Domestic travel insurance covers you when you're travelling in Australia, whether it’s for a weekend city break or a month-long road trip to see the sights. Domestic insurance can provide cover for things like:

- Changed or cancelled plans

- Lost luggage and personal items

- Rental vehicle excess

- Cover for your pets or booked childcare if your plans change

- Personal accidents and liability

Working overseas or taking more than one trip?

Everyone travels differently and you may have some requirements that are different to a standard international policy. If you’re planning to work overseas or you know you’ll be taking many trips within a year, the cover you need may be different, so its important to find a policy that suits your needs. Our Working Overseas or Annual Multi-trip policies may be great places to start when you're looking for cover in these situations.

How to compare travel insurance benefits

When you’re comparing travel insurance policies, it’s important to compare the benefit limits, sub-limits, excess and terms outlined in each benefit type. You can find this information in the insurer's product disclosure statement. This will help you to learn:

- What benefits you're covered for (e.g. medical expenses)

- The limits and any sublimits that apply to each benefit (e.g. how much you can claim up to)

- Any conditions or eligibility requirements that you need to meet in order to be able to submit a claim

- Any exclusions that apply to the cover.

What isn’t covered by travel insurance?

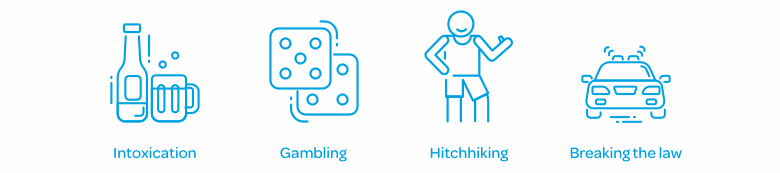

When comparing travel insurance policies, it’s important to take note of any exclusions to your cover. Travel insurers usually outline a list of general exclusions in their policy documents.

For example, amongst other exclusions, you may not be covered if you’re:

- Breaking the law of the country that you're visiting

- Under the influence of alcohol or drugs

- Gambling

- Hitch-hiking

Travel insurance for activities

There are some activities that an insurer may be reluctant to provide cover for altogether, or there may be conditions that apply when you're taking part in more high risk activities. Reading your policy wording will help you to know how you're covered in all of these instances.

Comparing different types of travel insurers

During your research, you may come across different types of organisations that sell travel insurance. Let’s look at some of the most common types of travel insurance providers and some things to consider for each.

A key thing to note is that most insurers offer a ‘free look period’ which is a period of time between purchasing your policy and leaving home on your travels to amend or cancel your policy, without any financial penalty.

1. Direct travel insurance

Direct travel insurers, like us, provide travel insurance directly to customers without any middle men. Southern Cross Travel Insurance is proud to be a direct travel insurer – it means we can focus on being experts in travel insurance. We underwrite our own policies, so it's us – the same people that you buy your policy from – who will be making the decisions in the event that you have to make a claim. When you add on your insurance when buying your flight or holiday, you might find that your premiums are also more expensive.

2. Credit card travel insurance

Some credit cards may offer ‘complimentary’ travel insurance. However, it’s always important to check the benefits, cover limits and exclusions, so you have a full understanding of what you are and aren’t covered for.

You may be required to activate your travel insurance before you travel to ensure you’re covered. There may also be other rules that you have to follow to ensure you are covered, such as paying for your travel costs on that credit card.

3. Through travel agents

Travel agents may offer to organise your travel insurance by dealing with an insurer themselves. This may seem convenient, especially if you're purchasing it at the same time as a holiday that you've purchased through the agent. However, you may still want to consider doing some homework by understanding who is providing or underwriting the cover and reading customer reviews, looking at policy wording and comparing prices with other competitors to ensure you get the best value cover that meets your needs.

4. Through airlines

Some airlines offer a travel insurance product, which you can add to your flight booking. There may be an added convenience in buying travel insurance through your airline, but, as with travel agents, remember to check the pricing and be sure to compare thoroughly. As with any provider, pay special attention to the benefits they offer, their record of customer service and whether they provide 24/7 emergency assistance.

How to choose a travel insurer

When comparing travel insurance, as well as looking at cover benefits, it’s also good to look at whether they have been recognised with any industry awards and whether they have received positive customer reviews. These things may give you a better picture of the level of service you can expect. When comparing travel insurers, ask yourself if they:

- Have great customer reviews: we’re proud to have achieved an award-winning rating of 4.7/5* on ProductReview.com.

- Have won industry awards: we've won several industry awards through the years.

- Underwrite their own policies: we underwrite our own insurance, so we’re not reselling another company’s product.

- Offer 24/7 emergency assistance: our 24/7 emergency assistance means we're just a phone call away if you need us.

If you’d like any more information on which SCTI policy is the right choice for your next adventure, click here or contact us at info@scti.com.au.

Don’t always choose the lowest price cover

You may be tempted to select the cheapest travel insurance available however, before you commit to buy, it always pays to research the policy carefully.

Saving a few dollars on a budget policy may seem like a good option now, but when the unexpected happens overseas, you may find you’re not covered, which can end up costing you lots in the long run.

Reading customer reviews is a great place to start when researching the quality of a travel insurance provider's products and whether they deliver on their promises.

Get a quote for travel insurance

To see why our award-winning travel insurance is the best value for your next holiday, check out our range of policies to see which could be right for you.

*Data correct as of 15 August 2023

What you need to know

This page includes some information about our products but, as with all insurance policies, eligibility criteria, terms and conditions apply. For our terms and conditions (including information about exclusions, excesses and sub limits) we recommend you read the relevant Financial Services Guide (FSG), Product Disclosure Statement (PDS) and Target Market Determination (TMD) to ensure our travel insurance products are right for you.

You can find the relevant documents here: International Comprehensive, Annual Multi-trip, International Medical Only, Working Overseas, Domestic.